In the native version of Odoo, it is possible to set a Credit Limit per customer, however, it is limited only to setting the Credit Limit amount and showing Informative messages on the Sales Order and Invoice in case the limit is exceeded for the selected customer.

This functionality is not sufficient in many cases and a more comprehensive solution is needed. Functionality that will provide more control over the financial risk but at the same time flexibility in setting up and detailed overview of it. The module that allows all these is the Account Financial Risk module.

Security

From a security perspective, the module has two access groups User and Manager. The User group allows a read-only access to the Financial Risk data.

The Manager group, on the other side, allows full access to the Financial Risk functionality. Additionally, the users with this group can overpass partner risk exceptions during Invoice confirmation. However, this group is not enough to see the tab Financial Risk in the Customer form view. That means to have full access to the features from this module it is required to have both Financial Risk Manager and Billing Administrator/Accountant groups. The accounting group is controlling the view of the Financial Risk tab.

Financial Risk Tab

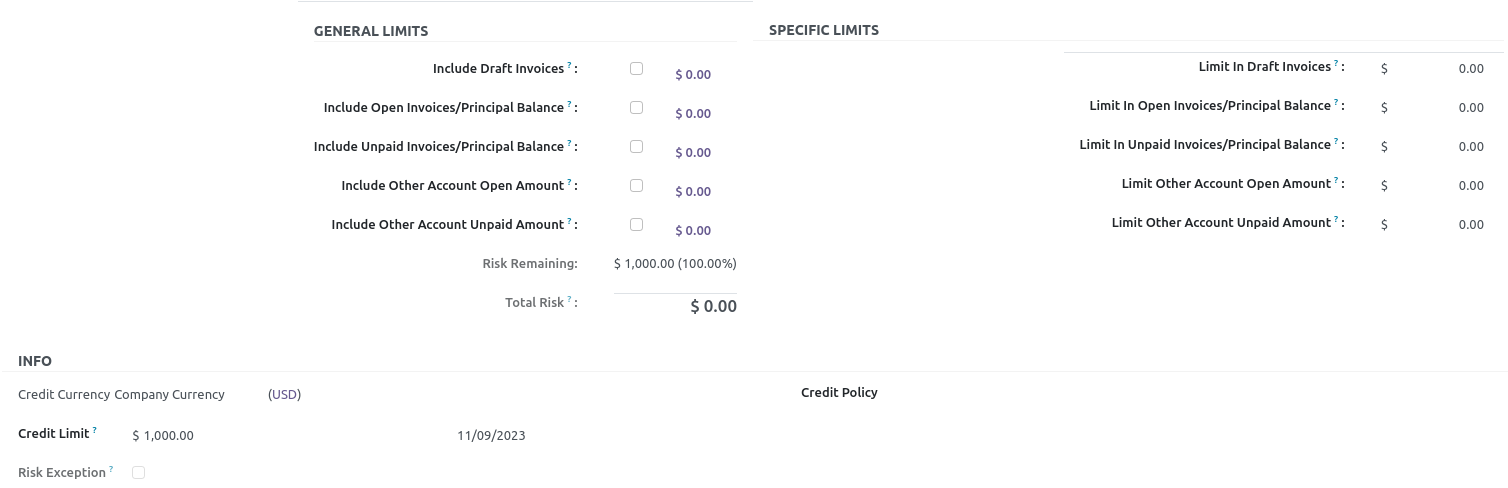

Once the module is installed in the system the tab Financial Risk can be found in the Partner form view. The Tab contains a complete overview of the financial risk for the particular customer.

On the left side can be found the General Limits section which contains the type of credit limits that can be included in the Customer’s Financial Risk, together with the current amount for each of them. The available types of credit limits are:

- Draft Invoices

- Open Invoices/Principal Balance

- Unpaid Invoices/Principal Balance

- Other Account Open Amount

- Other Account Unpaid Amount

Unpaid Invoices/Principal Balance type by default includes move lines with account same as the customer’s receivable account which are not reconciled and their due date is passed.

However, the module introduces an option of specifying additional margin before a move line is considered as Unpaid. This configuration is per company and can be found on the accounting configuration page under the name Maturity Margin. The value specified for this setting represents the number of additional days before a move line is considered unpaid.

"Other Account" limit types are move lines with account different than the customer’s receivable account which are with not past date or passed respectively. The Maturity Margin is taken into consideration for the Other Account Unpaid Amount as well.

At the bottom of the General Limits section, there is info about the Risk Remaining and the Total Risk for the customer, which is a sum of all included limits for that customer.

On the right side, can be found the Specific Limits section. In this section can be specified different limits for each type of credit limit.

Additionally, in the Info section it is possible to set a general credit limit per Customer. This limit is overpassed when the total amount that the customer owns from the selected General Limits is bigger than the set credit limit. Furthermore next to the Credit Limit is available the date when it was last updated.

Also in this section can be set the Credit Limit Currency. The available options for it are the following:

- Company Currency

- Receivable Currency

- Pricelist Currency

- Manual Credit Currency.

In case of selecting the Manual Credit Currency, an additional currency field is shown where the needed currency can be selected. Another available field in this section is Credit Policy, which is only informative and is not used anywhere in the system.

Invoice Confirmation

In case a customer exceeds a certain limit on confirmation of an Invoice “Partner risk exceeded” modal is shown. If the user has the Financial Risk Manager group there is an option in the modal to overpass the Risk Exception and continue with the Confirmation. Otherwise, the Confirmation will be blocked until the Financial Risk Exception for the customer is resolved.

Additionally for cases where this type of limitation is not needed there is a setting that allows invoices to be confirmed for customers with exceeded credit limits by all users that have access rights to confirm invoices. This feature can be enabled by selecting the option “Allow invoice validation over the risk” on the invoicing/accounting configuration page.

Financial Data Overview

The module allows a simple way of overviewing the financial data that is contributing to the current financial risk calculation for a customer. By clicking on the number next to each type of general limit will open the “Financial Risk Information” view, from which can be opened the list of Account Move Lines that are contributing to the Financial Risk for each account. This view can be opened by clicking on the number next to the name of the account.

This module is a great addition to the existing accounting features in Odoo. However, It is only related to the accounting part of the system and will not limit any action related to the Sales Order. In case such a feature is needed, a great addition to this module is the Sale Financial Risk module.

The module is maintained by the Odoo Community Association (OCA).

In addition is a short video with the module’s features.